Invoicing cycle and invoice payments

Questions about your OGOship invoices? Please read through this guide to get more details.

Invoicing cycles and payment terms

All aggregate invoices, including both warehousing and logistics costs, are sent out once a month normally by the 15th. The invoice detail shipments from the previous month as well as month-to-date shipments.

The only exceptions are VNL and UTL operations-related transactions - invoices for VNL and UTL transactions are sent bi-weekly.

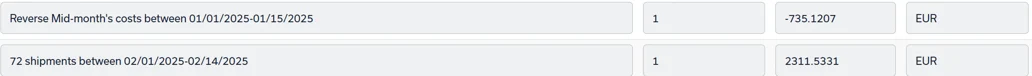

Kindly note that Your first invoice might be a bit higher depending on when the first shipments are being dispatched and it contains also the month-to- date shipments for the first time. In the following month's invoice, the month-to-date shipments from the previous month will be deducted.

Also, some freight-related transactions are invoiced bi-weekly (invoice contains only freight fees from the past half month) - depending on the freight company. For example, Posti, GLS, Budbee, DHL Express Finland/Estonia and DB Schenker transactions are invoiced bi-weekly.

In some cases, freight-related transactions may not be included in the invoicing period the freight was actually shipped. If, for example, an order has been shipped on the last day of the month, freight fees might be invoiced in the next invoicing period.

Our payment term is 10 days net and it applies to all merchants.

Also note that in some cases the order date does not match the invoicing period. For instance, if an order has been shipped on the last day of the month, it might be invoiced in the next invoicing period.

Invoice payment

The invoicing currency for the warehouse in question can be seen on the Warehouse specification sheet. The company has separate accounts for different currencies. OGOship accepts payments only in the currencies listed on the Warehouse specification sheet.

All payments will be paid to one of OGOship's company accounts as a bank transfer. The company accounts are currently operated by the OP bank in Finland, including also the SEK account, and Sweden. The company accounts are given in the IBAN format. If an international bank transfer is used, the payment costs must be divided as follows: the invoice payer is responsible for the costs incurred by his/her own bank, and the payment receiver (OGOship), is responsible for the costs incurred by the receiving bank.

The invoicing address used should be input by the merchant to the Merchant setting page. Email (PDF) invoices are the default invoicing method and electronic invoices (in selected countries) are also available.

Invoice value-added tax (VAT)

VAT will be added to the invoice depending on where the company to be invoiced is located and where the shipments are sent out from.

If a company receiving the invoices is outside the VAT region of the warehouse in question, the invoice will be sent out with VAT 0 %: transactions are subject to the reverse charge. However, for EU companies, a valid VAT code is required to be entered into the merchant setting page in myOGO to enable VAT 0 % invoices. Companies outside the EU need a valid registry/company number in order to receive VAT 0 % invoices. In case the VAT code is not input or is invalid, VAT will be added to the invoice.

Late payments

In case an invoice is left unpaid, OGOship will send out payment reminders. After two reminders, overdue invoices will be transferred to a collection agency. Interest on overdue payments as well as collection fees will be claimed from your company. The late payment fees and reminder invoice fees will be invoiced as separate invoices after they accumulate.

- 1st reminders are sent 7-9 days after the due date,

- 2nd reminder 7-9 days later,

- 3rd step: the collection of the receivables will be assigned to the collection agency.

In the event that the Merchant leaves OGOship’s invoices unpaid, and the invoices are overdue more than 7 days, OGOship has the right to stop shipping the Merchant’s shipments and suspend the account. Shipping will be opened when all open invoices are settled.

* This is an example of an invoice that has been issued on 14.2.2025. It includes the month-to date shipments for period 1.2-14.2.2025 and the month-to date shipments from previous month are being deducted.